Trade Idea: Elon Musk Net Worth on March 31st?

Market: Elon Musk’s net worth to be below $330bn by March 31st

Current odds: 77%

Return: 30%

Resolved by: March 31st

Position Size: Full

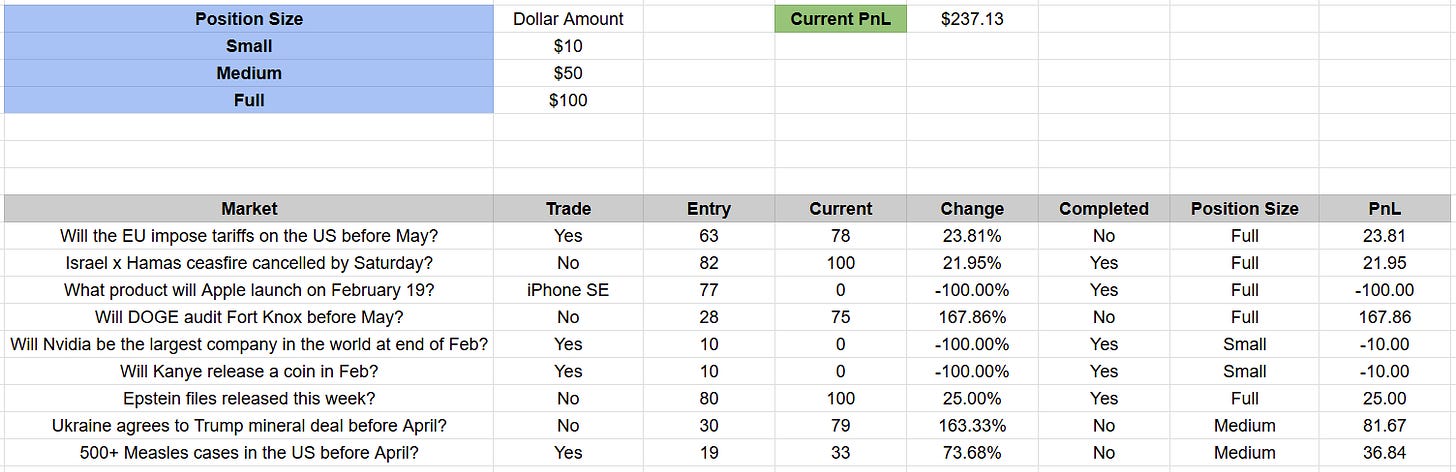

Welcome back to the Poly. Before we get into today’s trade I want to take a moment to review our results thus far. We posted our first article on February 10th, so just over one month ago. Since then, we have been tracking our returns using a $500 test account, which is currently sitting at $737.17, giving us a total gain of 47% in just over one month of trading. We split our trades into three different position sizes - small ($10), medium ($50), and full ($100) - based on the risk profile of each trade. Below is a graph illustrating every market we have written about, what the price was when we posted the article, and the current price.

The first month was a great month of returns for us. To put this return into perspective, 47% per month compounded over 12 months is a 100x return, which would turn our original $500 into $50,000. Of course, it is unlikely that we will continue compounding at this rate for an entire year due to scaling limitations, but it does show how profitable Polymarket can be if you do the right research and make the right trades.

Elon Musk's Net Worth: Current Status

Today's trade centers on Elon Musk's net worth as of March 31st, as measured by the Bloomberg Billionaire Index, which currently values his fortune at $312 billion. The majority of this immense wealth is derived from his ownership stakes in private ventures such as SpaceX and X (formerly Twitter). Since private company valuations are reassessed far less frequently than their publicly-traded counterparts, we can reasonably assume these components of his portfolio will maintain stable valuations over the coming two-week period.

This leaves Tesla—Musk's only publicly traded major holding—as the sole variable that will meaningfully impact his official net worth in the short term. Musk currently holds approximately 13% of Tesla's outstanding shares, a stake valued at roughly $97 billion at current market prices.

To reach the $330 billion threshold, Musk's net worth would need to increase by $18 billion from its current level. When we isolate the factors that could realistically affect his net worth within this brief timeframe, the market question essentially becomes: Can Tesla's stock price surge by 18.5% over the next two weeks?

Why a Large Tesla Rally Is Highly Improbable

Tesla's stock would need to climb to approximately $272.40 to push Musk's net worth to $330 billion—a scenario that appears increasingly unlikely given multiple converging headwinds:

Fundamental Challenges

Tesla's business fundamentals have deteriorated significantly, creating substantial obstacles to near-term price appreciation. Q1 2024 automotive revenue dropped 8% year-over-year to $19.8 billion, with European sales collapsing by 45% in January alone. The situation appears even more dire in China and Australia, where sales have plunged approximately 50%. Analysts have consequently revised their Q1 2025 delivery projections downward to below 387,000 units—a significant reduction from previous estimates exceeding 400,000 vehicles.

Despite having already declined 39% year-to-date, Tesla still trades at an extraordinary P/E ratio of 110, dramatically higher than the S&P 500's average of approximately 20. Even at the current price of $238, the stock remains priced for explosive growth that current operational realities simply don't justify. This fundamental disconnect between valuation and performance creates a significant barrier to the kind of rapid price appreciation needed to boost Musk's net worth in the near term.

Operational Risks

The company faces serious operational challenges that further diminish the likelihood of a rapid stock price recovery. Tesla's aggressive price reductions, implemented to counteract declining demand, have significantly eroded profit margins. This deterioration is reflected in 2024 earnings per share, which have plummeted 52% to just $2.04. Such dramatic profit compression makes it exceedingly difficult to justify the premium valuation necessary for a substantial stock price increase.

Highly anticipated product refreshes like the updated Model Y and planned new vehicle launches continue to face delays. Perhaps more concerning, Tesla's full self-driving technology and robotaxi ambitions—cornerstones of the company's future valuation thesis—remain unrealized after years of missed deadlines and technological setbacks. These innovation delays undermine investor confidence in the company's ability to maintain its technological edge and future growth trajectory.

External Pressures

External factors compound Tesla's difficulties and create additional barriers to short-term price appreciation. Elon Musk's increasingly vocal political positions, including his support for Donald Trump and various controversial right-wing groups, have alienated consumers in critical European markets. This impact is particularly evident in Germany and France, where Tesla sales cratered by 76% year-over-year in February. Such dramatic consumer backlash in key markets raises serious questions about the company's near-term sales prospects.

Escalating tariffs between the United States and China threaten to disrupt Tesla's supply chains and restrict access to key markets, introducing further uncertainty into the company's operational outlook. These trade tensions add another layer of complexity to Tesla's global operations and cast doubt on its ability to navigate an increasingly challenging geopolitical landscape.

Market Sentiment

Current market sentiment provides little basis for optimism regarding an imminent price surge. While some bullish analysts maintain targets as high as $550 (Wedbush), bearish forecasts such as JP Morgan's $120 price target highlight profound skepticism about Tesla's growth trajectory. The consensus 12-month target of $340.31 suggests no clear catalyst for a sharp near-term rebound. This analyst divergence reflects broader market uncertainty about Tesla's future prospects.

Recent price action has been decidedly negative, with the stock breaking through critical support at $263. Although the Relative Strength Index of 24.49 indicates oversold conditions, no clear reversal pattern has emerged to suggest an imminent bounce. Technical indicators thus provide little evidence for a rapid recovery in the near term.

Limited Short-Term Catalysts

While upcoming events such as Q1 delivery results (expected April 2) and potential robotaxi updates (anticipated in June) could introduce volatility, neither seems likely to trigger the magnitude of price movement required. Delivery estimates have already been substantially downgraded, reducing the potential for positive surprise. Additionally, Tesla's history of missed deadlines regarding FSD and robotaxi technology has eroded credibility around these announcements, diminishing their potential impact on stock price.

Given this constellation of challenges, a 18.5% rally within just two weeks would require an extraordinary and unexpected positive development—something Tesla's current trajectory and prevailing market sentiment provide little reason to anticipate. The combination of fundamental weakness, operational challenges, external pressures, and negative market sentiment creates a formidable barrier to the kind of rapid price appreciation needed to boost Musk's net worth to $330 billion by the end of March.